Lending to military members is an ever-increasing concern, and it’s an area the CFPB has already cracked down on. But due to a high volume of complaints exposed in a recent report, the CFPB may be coming down even harder.

High CFPB scrutiny for servicemembers is nothing new. During the mortgage crisis, the CFPB determined that more than 700 military members were wrongly foreclosed on. And in another instance, one order from the CFPB forced auto lenders to refund $6.5 million to more than 50,000 servicemembers. And the CFPB shows no sign of easing up.

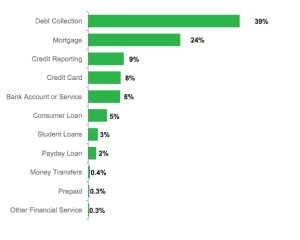

In its recent complaint report (the third of its kind), the CFPB’s Office of Servicemembers Affairs outlines data and trends from complaints submitted by servicemembers, veterans, and their families. Although many financial institution were following regulations to a T, the servicemembers often felt wronged due to poor communication or understanding. And with the changes in the CFPB Complaint System, it’s important to stay ahead of the criticism curve. The report presents major trends in what servicemembers complain about, as well as how financial institutions respond to them. The CFPB’s findings present observant financial institutions a fairly good roadmap what is on its radar screen.

Major Concerns

Debt Collection — 39%

By far the greatest complaint from servicemembers concerned debt collection. Most notably, 40% of their debt collection complaints had to do with “continued attempts to collect debt not owed.” In many of these cases, the attempt to collect the debt is not the problem in itself, but the servicemembers say the underlying debt is inaccurate or unfair. And the calls on these incorrect debts are a problem; servicemembers complain that telephone collection calls are too frequent, and that these calls sometimes come to their place of employment or third parties. Some military personnel even received threats from debt collectors to report unpaid debs to their commanding officers, to have the servicemember demoted in rank, or even to have their security clearance revoked if they do not pay. Click here to read a blog post from the CFPB concerning this matter.

Mortgage — 24%

Mortgage — 24%

The most frequent complaint concerning mortgages has to do with “problems when the servicemember cannot pay.” This includes loan modifications, collections, or foreclosures. Some servicemembers with successfully completed loan modifications have complained that some servicers do not amend derogatory credit reporting accrued during trial periods, even when documents stated the lender would.

What’s more, many servicemembers experience troubles with loss mitigation when they receive Permanent Change of Station (PCS) orders. Remember that the CFPB issued new rules in 2014 that address some of the trickiest problems in mortgage servicing industry that bring new rights and protections to military personnel borrowers.

Credit Reporting — 9%

Servicemembers were overwhelmingly unhappy with finding “incorrect information on credit reports.” The complaints said that incorrect information included account terms, account status, personal information, public records, and reinserted previously deleted information. Many servicemembers who submit credit-reporting complaints hold the ongoing fear that any negative information on their credit report may cause their security clearance to be pulled when up for review. And these military consumers have an added fear that inaccurate reporting could potentially affect their military career.

Usual Company Response

Of the 29,500 complaints from military personnel analyzed in this report, 64% were sent by the CFPB to companies for review and response. The responses from these institutions included steps taken or that will be taken, communications received from the consumer, and any follow-up actions. Overwhelmingly the response from companies was often “closed with explanation.” This was the response to more than 70% of the complaints sent to companies. The original filer of the complaint was then given an opportunity to respond to the formal response from the companies. Overall, 22% were unsatisfied with the explanation and chose to dispute the company’s response. These complaints often undergo stronger review and investigation from the CFPB.

Major Suggestions

At the end of the report, the CFPB summarizes the frequent concerns and complaints of servicemembers and offered the following four suggestions:

- Prior to altering military-specific account conditions of use, financial institutions should seek to obtain an updated mailing address from their military consumer

- Financial institutions should provide clear instructions on how a person designated by a servicemember may gain access to an account, and what things that person can and cannot do with the account. If different levels of access exist, this should be clearly explained, along with instructions on how the servicemember account holder can authorize each level.

- Financial institutions should proactively notify military consumers about any POA company policies. This should include whether or not POAs are accepted, and, if so, which type is required based on the consumer’s needs. If a company requires a specific format or language for a POA, that should be provided on its website. Legal Assistance offices within the military routinely prepare both General and Specific POAs, and can generally include whatever specific language a client needs within the Specific POAs. Financial institutions should provide clear guidance to their military consumers about the language or format they require so that the servicemember can be sure to create a sufficient POA.

- Financial institutions should ensure they have feasible methods of communication for all their consumers. For military consumers, limiting communication to telephone or fax to resolve issues greatly impacts the ability of deployed servicemembers to conduct bank business, especially if that communication is only available during US business hours.

Data and figure from OSA Report “Complaints Received from Servicemembers, veterans, and their families, Spring 2015”