Complaint management used to be so simple. Perhaps your institution looks back fondly on the days when complaints were usually over the phone about a billing issue. But in this day and age, customers, members, and even employees have a cornucopia of complaint outlets, such as Facebook, Twitter, Yelp, and of course, the CFPB’s complaint database or even your institution’s own website. In this era of prolific information sharing, consumers are complaining in more ways than ever before. That’s why every institution needs an effective response system. Here are five key points to assist financial institutions in accomplishing this task.

1. Perform a Risk Assessment

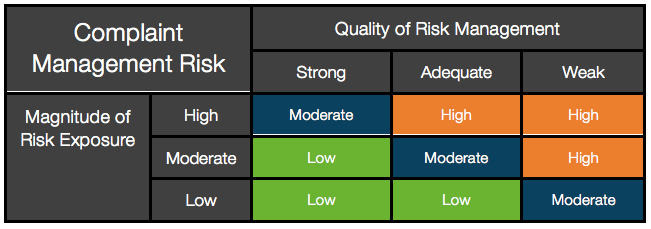

Every institution needs to—as we like to put it—know who they are. It’s important to know where your institution already stands relative to complaint management. This includes understanding your overall risk profile based on assessments of both your magnitude of risk exposure and your quality of risk management (see Figure 1). The gap between the two is your residual risk. It’s impossible to overemphasize the importance of a risk assessment. If, after evaluating these factors, you discover that your institution’s residual risk is high, you will need to focus on developing strong complaint management procedures. If your residual risk for this area is low, either your program is already working well, or you have a lot of happy customers or members. If the latter is true, it’s still a good idea to work on developing a sound complaint management policy, because in this day and age, it doesn’t take much to send a customer or member on the warpath.

2. Discover Expectations

Secondly, before you can really start to improve your policy, it’s important to know what’s expected from both examiners and consumers. This means you need solid, up-to-date knowledge of regulations, and a knowledge of which parts of these regulations examiners focus on. For example, when you’re creating your Complaint Management Policy, it can be a good idea to take a look at the CFPB’s examination guide, so it incorporates preferred practices that your institution would ideally have in place.

3. Centralize and Integrate Policy

Next, focus on both centralizing and integrating your policy. By “integration,” we mean that complaint management should be an element within other policies (such as fair lending, debt collection, etc.). However, you should also have a centralized, written policy to unify complaint management efforts. This would include guidance on organizing a committee, developing proper response procedures, documentation processes, etc.

4. Set Complaint Priorities

It’s important to give every complaint the attention it deserves. However, not all complaints are created equal. When it comes to trying to figure out which complaints carry greater weight, you have to consider the nature of regulations and their impact. Most regulations carry penalties of $10,000 to $500,000, depending on the regulation. Dodd-Frank, however, has a tiered penalty system that can bring penalties up to over $1 million for each day violations occur. This means that any complaints that fall under consumer protection regulations should receive some extra attention. Complaints falling under laws associated with fees, such as UDAAP, EFTA, and TILA, as well as Fair Lending laws and the Servicemembers Civil Relief Act should also be closely managed.

5. Training, Training, Training

What’s the use of a robust complaint management policy if your employees aren’t instructed on using it? Hopefully you’ve identified in your policy specific individuals charged with responding to complaints. Those individuals should be fully versed in proper complaint management procedures and behavior. However, the rest of your employees should also be trained on the proper avenues for complaints—the individual to whom they should send customers/members with grievances of various types.

6. Adapt

You must continually evaluate and adjust your program based on current trends or issues. A key part of this step is undergoing a yearly risk assessment to monitor the effectiveness of your institution’s program. Furthermore, we recommend updating your complaint management program and getting it reviewed and approved by the Board of Directors at least annually.

Following these six suggestions will help your institution turn complaints into compliance. With a strong complaint management program in place, you’ll no longer have to dread dealing with complaints. Your customers will be happier because you’ll be better equipped to address issues. Well-managed complaints will reveal areas that need improvement, and will improve your institution as a whole.