Why Now is Actually a Smart Time to Review Your Bank’s Pandemic Plan

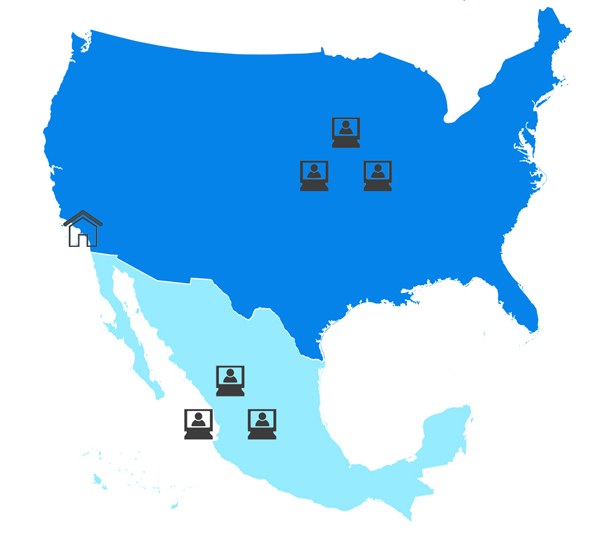

AffirmX has long been the leading solution provider of compliance and risk assessment services delivered remotely. We pioneered the off-site approach to ongoing compliance services delivered remotely as a more cost-effective and efficient solution. But with the recent uncertainty surrounding the potential impacts of COVID-19, remotely delivered services make even more sense. Being in the [...]